On Tuesday 5 December 2023, the LMA hosted its first Private Credit Seminar. The event proved to be incredibly popular with almost 500 registrations within the opening weeks (before we had to close).

We will ensure there is more capacity next time, but for those who were unable to get one of the limited seats, here are some key takeaways:

The opener

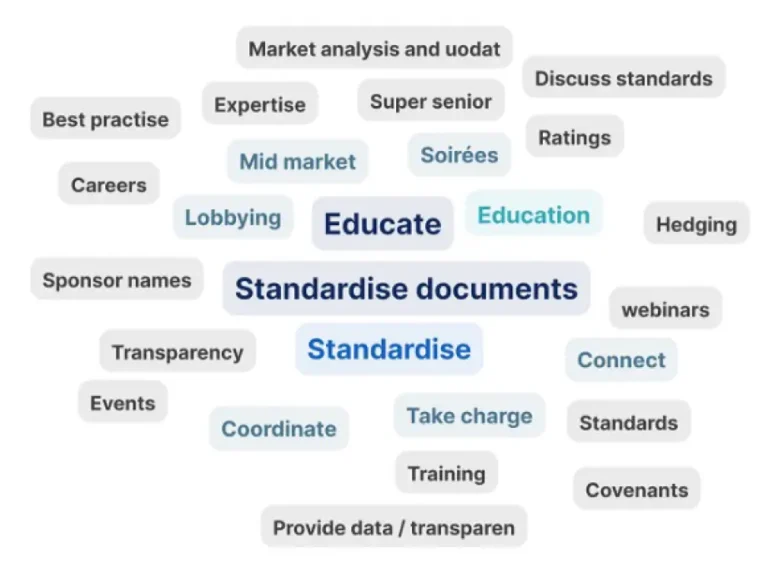

Scott McMunn, CEO of the LMA, opened the event highlighting not just the size of the private credit market, but also the interest in it with some fun facts. The market has its advantages, but also has challenges and risks which is where the LMA will continue to serve the market. The LMA is increasing its engagement in this sector and will work on events, workshops, guidance and principles (in line with the core values of efficiency, transparency, liquidity and sustainability).

On that last note, work includes a joint best practice guide (with LSTA, ELFA, ACT, BVCA, CWT) on applying sustainability-linked loan principles in private credit (watch this space!). The audience were invited to share their views on what they would like to see from the LMA – calls for education, standardisation, lobbying and events were no surprise.

The data

Up next, we had a walk through the available data which set the scene for the afternoon’s discussions. The private credit market is estimated to grow to $2.8tn by 2028. The transition from the mid-market to jumbo deals (recently reaching $5.3bn) is a trend that cannot be ignored. Over the past five years, returns have outperformed private equity, corporate high yield and leveraged loans, making this a very attractive asset class. The long-term outlook is bullish with LPs expecting to focus on direct senior lending compared to other structures. Although private credit has taken a share of the leveraged loan market, banks and private credit have been working together in this space.

Sectors in focus include technology, financials, healthcare and communications, with European direct lending largely concentrated in the UK, France and Benelux. With the maturity wall approaching next year, it remains to be seen whether existing bank deals will amend and extend, or be refinanced in the private credit market. Whilst a current lack of data and transparency is noted in the market (the clue is in the name), as the market matures parties will increasingly want to see comparables.

Regulation — key takeaways from IOSCO’s report

Regulation is a key talking point, with IOSCO publishing a report this year on emerging risks in private finance (as well as the ongoing consultation on good practices for leveraged loans and CLOs). This coupled with comments from other regulators on risks within the private credit market is evidence of a desire on the part of regulators to have a solid grasp on an increasingly large part of the market which could have wider market implications.

Although the IOSCO report highlights certain challenges, it also highlights the positives of private credit. The impact of higher interest rates, as well as conflicts of interest, are concerns highlighted. However, no specific imminent risk is noted in the report. Certainly the market will keep a watching brief for developments in this space. The LMA is working with the market, and liaising with other trade associations, on its response to the IOSCO consultation on good practices.

LMA ‘unitranche’ documentation — key aspects

This session walked through the main features of the LMA’s senior / super senior intercreditor agreement. First published in 2018, this documentation project brought together banks and private credit funds within the same working group to establish ICA parameters. Key aspects of discussion included ranking and control of enforcement, standstills, entrenched rights, value protection and hedging. The difference between the ICA and agreements among lenders (which are more often seen in the US) was also highlighted in the session.

The LMA will reconstitute its working party in 2024 and take a fresh look at the ICA, as well as other documentation to help the market.

How banks and private credit work together

The first panel session opened with a consideration of structures in the market. There has been a shift to club style unitranche deals. This has raised interesting issues around entrenched rights and veto rights, with the relative size of the super senior to the unitranche changing the nature of provisions with entrenched rights.

Picking up on recent comments in the press about lending to corporates being the ‘hot new trend’ for banks, the panel explored ways in which banks are adapting to the new dynamics in the market. Ultimately there are different ways in which banks will look to stay relevant. Whilst certain private credit funds can offer bank type products (such as RCFs), the bank super senior RCF is still a common structure (with some debate as to whether RCFs present a good use of capital for funds). However, super senior term loans are on the rise. Agency functions are also a topic of discussion, with certain private credit funds being able to offer agency functions (although use of bank or third party agents is more prevalent).

There was a competition as to who could get the most ‘bus’ related metaphors into the discussion on enforcement. Questions such as: “who drives the bus?” and “who can take control of the steering wheel?” still exercise the market. Ultimately enforcement is not just about getting the money back but can be driven by other factors (e.g. relationship). The importance of reading the documents (which we heard unitranche lenders actually do!) was reiterated with some cautionary tales.

Trends, challenges and opportunities

The final session of the afternoon focused on trends, challenges and opportunities in the private credit market, of which there are many. 2023 has seen a flight to quality with a subdued year for private credit and mid-market borrowers. Higher interest rates, whilst seen as a threat to the market being higher for longer, have offered better returns (and volatility has subsided). The anticipated levels of restructuring activity have also not materialised. Although there has been subdued M&A activity, there are green shoots. NAV financing is still finding its feet, with a variety of structures and market education needed (with Holdco PIK remaining difficult from a relative value perspective).

A theme of the afternoon was that private credit deals tend to be covenanted, with such deals attracting more liquidity. However, there has been a push from sponsors for covenant lite. Ultimately liquidity is what will remain in focus. The theme of regulation continued into this panel. Whilst not regulated in the same way as banks, private credit funds have regulated investors (i.e. pension funds). Regulatory and compliance requirements need to be met in respect of the funds themselves, as well as conduct and reputational considerations. It was noted that private credit funds are under high scrutiny.

Heading into 2024, whilst there is stress in the market the outlook is generally positive and the audience agreed (with 56% expecting to see more activity in the year ahead). The market will remain choosy around deployment of capital. However, opportunities are there in terms of geographies, non-sponsor backed deals, further P2P activity and sustainable finance (good timing for the upcoming LMA joint project!).

Overall, it was a great afternoon enjoyed by all. It was fantastic to see the energy and engagement in the room and the excitement for what lies ahead in 2024 and for the LMA’s plans to support this area. It would be great to hear your views and feedback and we very much invite you to get in touch!