Welcome to the second publication of “Challenging the Timeline” the LMA newsletter covering primary and secondary operations and agency.

Thank you for your encouraging feedback – please keep it coming to help us continue to improve. It is wonderful to see the newsletter attract over 4,000 followers after just one edition.

The loan markets, specifically leveraged finance, are dependent on the primary and secondary operations process, allowing participants effective use of balance sheet and risk limits and ensuring appropriate resource allocation.

The LMA is here to make your voice heard and promoting efficiency, liquidity, and transparency in our loan markets. Onwards and upwards!

Our second edition focuses on three key areas:

- Primary and specifically PDSC (you know what it is!)

- Secondary settlement times

- Agency business.

Primary and PDSC – guidelines are evolving and benefiting our members

Firstly, PDSC. We published our guidelines in April to strong fanfare and positive press coverage with immediate follow-ups broadening the outreach and soliciting further feedback from members beyond the initial consultation group. We knew these guidelines would evolve as we received this input: indeed, we encouraged it. With more meetings and more views, our aim was to assess whether our guidelines had gone too far or not far enough and to determine what, if anything, we had missed.

Over July and September, we have formally engaged with a large group of arranger banks and investors and will be updating the guidelines document in Q4 to reflect their feedback. We will also be collating market information and will be reporting that to our members from 2025 onwards.

We are pleased that deals are being issued that comply with the LMA rules and that PDSC is being applied to the benefit of our member firms. It is gratifying to see the LMA’s efforts leading to positive outcomes.

Secondary settlement times – promising early results

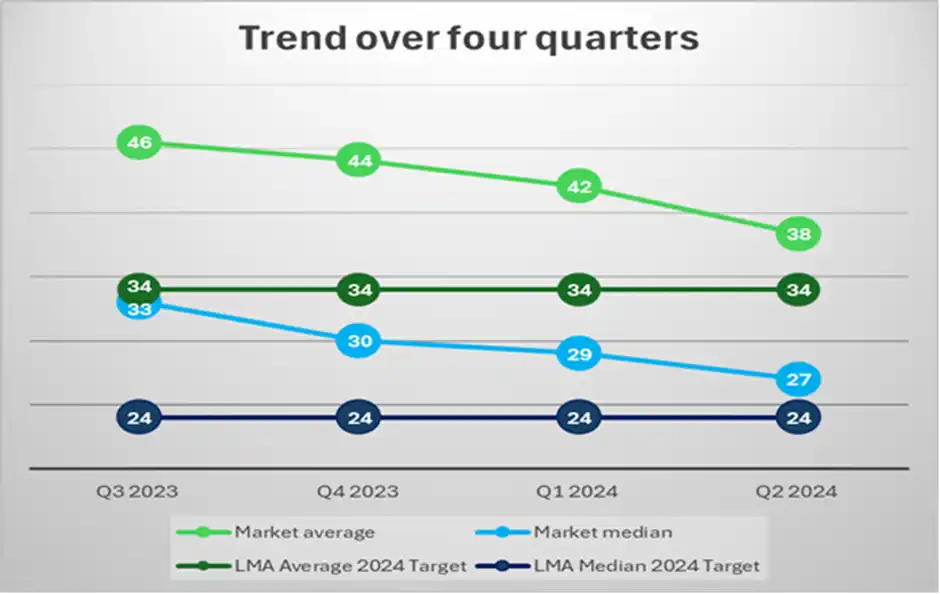

On secondary markets, we are still at an early stage in our journey – it is only four months since we held our Operations conference. As you know, 2023 reported average and median settlement times of 32 and 46 working days respectively. Our last data points for the end of Q2 showed significant progress again, as you can see in the chart below. As a reminder, the LMA set out our stall by initially providing data points and breaking out the 32- and 46-day timelines – and of course asking our members to focus on reducing these.

I am delighted to say that that the market has shown notable progress, even in the face of increased trading volumes, which have continued to rise since the end of Q2. The trend is moving in the right direction, with average and mean times reducing by six and four working days, respectively. With these increased volumes, dealers should continue to pursue efficiency gains, both through process improvements and by investing in technology and people.

The LMA has set a target of 25 percent reductions year on year. While achieving this will not be easy, we are confident that with sustained collective effort, it’s attainable. Some market participants are already reaching their targets, and some have made significant improvements in 2024, which should be applauded. However, others have further progress to make.

We have observed positive progress among some LMA members, and there is no better testament to the quality of the LMA’s work than these successful case examples. LMA are looking to take at least one such case example and showcase in the future so we can observe what has made the difference

Finally, it is important to note that a two-tier market is developing, with a gap between top and bottom performers of over four weeks. The LMA will be working with the outliers, informing them about simple process improvements and checking to see if any further assistance can be offered. Understanding each firm’s operational goals helps us gauge the achievability of the targeted reduction goals.

We continue to collaborate with the LSTA and look forward to joining their quarterly committee in late September.

Agency meetings – useful feedback that will inform our future activity

Finally, we met a number of the agency business lines over the summer to understand what they wanted from the LMA. With such a broad range of business models and firms, there was no single output, but rather a request to look at a number of new areas of focus. The LMA will include these members in our ongoing work – any efforts will be prioritised in the overall mix according to what they are doing to promote liquidity, efficiency, and transparency – and the benefits to our members.

Thank you for your support – by sharing learnings and highlighting examples of best practice, we can continue to make progress on improving settlement times. Please share your feedback and thoughts with me at [email protected]