Welcome to the new Operations newsletter from the LMA “Challenging the Timeline”.

The loan markets, specifically leveraged finance, are dependent on the primary and secondary operations process, allowing participants effective use of balance sheet and risk limits and ensuring appropriate resource allocation.

Post–Covid, more of our loan markets stakeholders have been pressing the LMA to facilitate greater progress in these regards and look to address some of the prevailing challenges.

With these considerations in mind, the LMA will now publish a regular newsletter covering all things Operations – primary, secondary for both loan settlements and agency – offering updates on our progress, our overall book of work, and highlighting our successes (which rely on you our members). This will bring more transparency and visibility to what the LMA is doing for you.

This will be published on Linkedin and made available to all market participants.

Settlement

As you will have seen in the CEO monthly newsletter, the LMA has been focused on primary and secondary settlement markets. Starting with secondary markets, our goal for 2024 is to reduce settlement times by 25 per cent, bringing us into closer alignment with our North American sister association the Loan Syndications and Trading Association (LSTA) and setting both associations up for further improvements in 2025. We are picking off some of the low-hanging fruit but are keenly aware that a permanent solution must be global, enabled by technology, innovation, documentation review and the LMA and LSTA helping to drive behavioural change.

As Head of Operations at the LMA, I conducted a series of one-to-one meetings with market participants earlier this year followed by larger workshops in Q2 to delve into the details of the timeline and brainstorm solutions. The LMA also created a new Operations Committee chaired by LMA Board member Doug Laurie of Barclays and including other senior leaders from the likes of Bank of America, JP Morgan and UBS Asset Management. This group will direct and drive the working groups.

LMA Operations Conference

The first step on this 2024 journey started with a reboot of our Operations conference. Nigel Houghton and myself, supported by the LMA events team, set up a unique conference structure to ensure correct engagement and the right attendees.

Our event kicked off with a morning session for those new to loans settlements teams or even those who needed a refresher. We shared best practices, war stories, and examples of embedding what good looks like. Over 150 people attended sessions on how the market has evolved over time, the timelines of the secondary transaction, an overview of LMA terms and conditions, transfer documents and the role of the facility agent and security agent.

"This is a people business"

"Respect your partners"

“A knowledgeable closer is an effective closer”

One challenge in Operations is attracting and retaining younger talent, creating a potential problem for the markets in the future. It is important to position it as a viable and attractive career path and show the impact it has on the wider business. New technology and the knock-on changes in processes and practice will help in this regard.

In the afternoon we held the main session, “Challenging the Timeline”, which drew around 200 attendees from 70 buy-side and sell-side firms.

“You can’t win Rocky” opened the event covering some of the scepticism our markets face in addressing a key issue. It is not often that Rocky 4 merges with leveraged loan markets but like (Rocky’s wife) Adrian was, many market practitioners have been pessimistic about the possibility of reducing secondary settlement times. Having so many senior leaders there in person demonstrated that there was an intent to take on this gloomy prognosis and win.

Starting the timeline with primary markets, our Managing Director Nick Voisey updated attendees on the good work that has been done on Primary Delayed Settlement Compensation and talked through our recently launched guidelines on the topic. The audience praised the achievement of the LMA Board in reaching an initial compromise and this raised hopes of more to come.

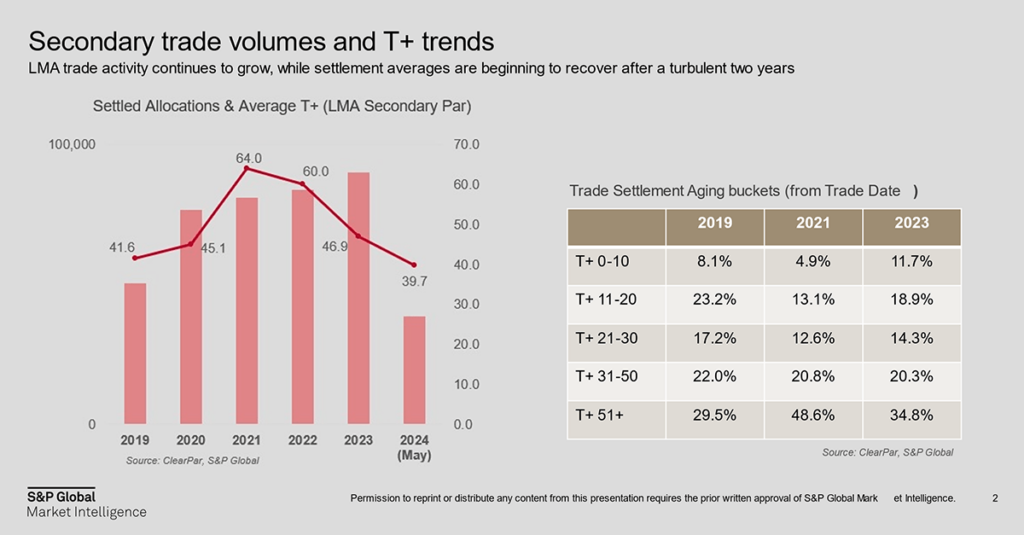

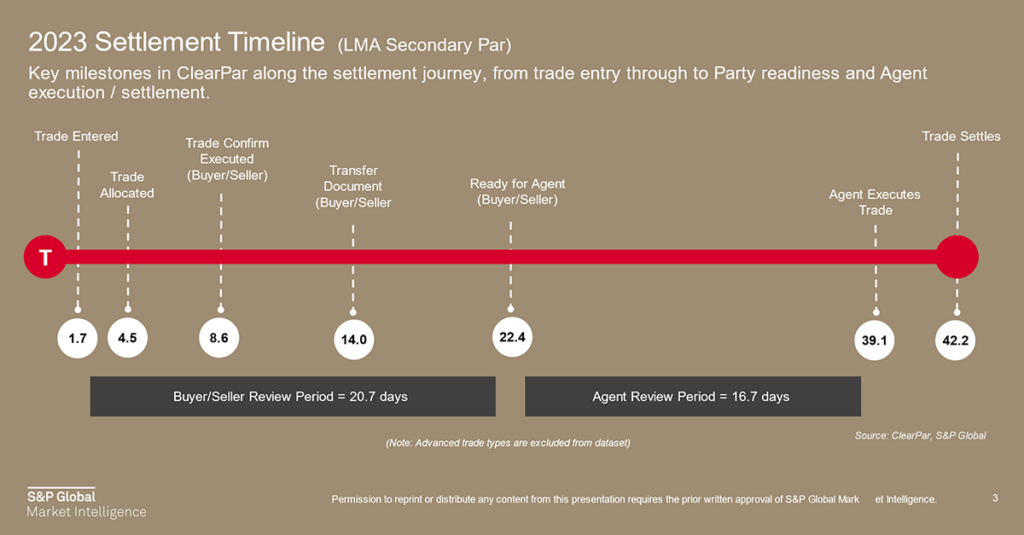

James Irwin at Standard & Poor’s presented current market views showing the success of our teams in reducing times from 60 days in 2022 to 47 days at the end of 2023 to under 40 now. In April and May 2024, average settlement times were 37 and 36 days respectively. We now need to address the long tail, which is the disturbing 35 per cent of trades settling after T+51. Panellists expressed concern that we risk looking like a two-speed market.

The session included several themes including confirmations, reference data, loan identifications, the use of technology and the role of agents. The good news was that rapid settlement is doable. Bids Wanted In Competition in particular settle extremely quickly and will generally settle within the suggested timeline of T+10 for a par/near par transaction.

The conference then looked at the use of technology and how this will drive further change. It is exciting to see the amount of money currently being allocated to the loan asset class in both private and public markets. This will attract more technology investment. This technology will focus on infrastructure, software and data solutions and our panellists explained a few use case benefits.

Our final session featured a challenging question about how Operations will look next year. The answers were mixed, but included the aim of applying technology where we can, exploring some T+0 use cases and striving to create a journey that is digital end to end, and origination to agency all processed. It was an exciting vision of the future and the LMA is committed to supporting you in achieving these much-needed changes.

There was a clear conclusion that we can win the battle of reducing settlement times to an acceptable level. However, behaviour change is needed and this will be motivated by

- Desire

- A clear benefit

- Hard work, perseverance and resilience and

- Shaking off the KGB drag.

Summary

The LMA view is that we will get to T+25 if we all work together to achieve this. We will get 10 days of improvement through technology and another 10 days will require behavioural change. A small number of market leaders on both side of the distribution curve will have a major influence on the outcome.

We are committed to achieving success and we believe many of the key market stakeholders are too and we will work to enable this together.

We will update on Primary Delayed Settlement Compensation in the next newsletter.