Welcome to the fifth edition of Challenging the Timeline – the LMA newsletter focused on primary and secondary operations.

-

Settlement metrics

-

Loan operations conference: Gearing Up for Change

-

What’s next

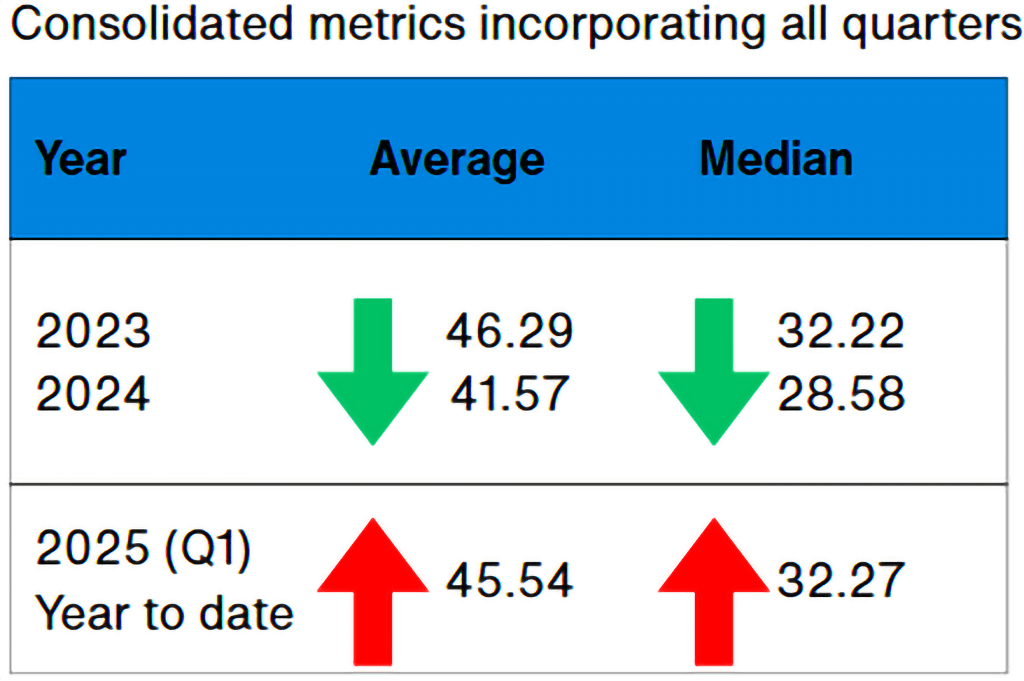

Settlement metrics: 2024 saw some level of success when you focus purely on the metrics (Secondary Par). While it wasn’t the significant reduction we hoped for, any reduction is still a step in the right direction. A quick reminder 10% reduction at the end of 2024 when compared to 2023.

Therefore, after not reaching our 2024 target of 25%, it’s equally disappointing to have to communicate that this trend has been reversed in the 1st Quarter 2025.

However, metrics only tell part of the story. There is a tendency to focus to much on the numbers, but we need to dig deeper to understand what the drivers of these numbers are. Is this a temporary spike and/or is a justifiable cause behind it? More importantly, are there solutions to help the industry reverse these trends?

Loan operations conference:

The upcoming loan operations conference will provide insights into these challenges and more, delivered by a group of expert panellists. In addition to addressing the issues around settlement, some of the key highlights include a tech panel discussing AI, sessions on withholding tax, distressed debt, and private credit, as well as a breakout room dedicated to training and education. If you are an LMA member and have not registered, please do so as soon as possible as there are limited spaces still available. Click here to register.

When and where: 10th July 2025 Loan Ops conference. Cavendish Venues – The Minster Building, 21 Mincing Lane, London, EC3R 7AG

My next newsletter will be more detailed as I reflect on some of the content, so I’m keeping this edition short while I prepare for the conference.

Before I get back to preparing for the Loan Operations Conference, I’d like to take a moment to reflect on the nature of loan operations, which has, in many ways, shaped the theme for this year’s conference: “Gearing Up for Change.”

When I was originally asked for a theme, I wanted the strapline to capture the essence of loan operations. Challenging the timeline in 2024 felt like the perfect fit, as it mirrored what we were trying to achieve. However, “Gearing Up for Change” carries a more subtle message. I envisioned interconnecting cogs to symbolise the lifecycle of a loan, where various loan operations partners work towards the same overall goal. Like the cogs in a machine, there is a dependency on each other to deliver the final product. We should not lose sight of this we should have the utmost respect for our partners and understand their challenges before we are too critical. Loan operations is still very much a people business and working together we can achieve so much more.

I look forward to seeing many of you at next week’s conference, and I’m truly excited to Gear Up for Change alongside so many experts in the room.

You’ll hear more in the next edition – until then, please stay connected and don’t hesitate to share your feedback with us.

Paul Tylor

Head of Operations